Transaction cost theory attempts to answer the questions “why” or “what do firms exist for”, understanding firms as a particular type of organisation. These types of organisations have a managerial hierarchy that allows them to manage transactions to minimise costs.

The first notions of the theory were introduced by the economist Ronald Coase, winner of the Nobel Prize in 1991, to contribute to “the importance of transaction costs and property rights for the functioning of the market”. But Oliver Williamson, an American economist who won the Nobel Prize in 2009, together with Elinor Ostrom for their contributions to the “analysis of economic governance“, gave shape to what we know today as transaction cost theory.

Definition of transaction cost theory

Business management entails costs that are not captured by prices, such as finding the product, negotiating contracts to carry out transactions, the cost of differentiating the relevant price and cost ensuring that what has been agreed is fulfilled. All these non-price costs are called transaction costs.

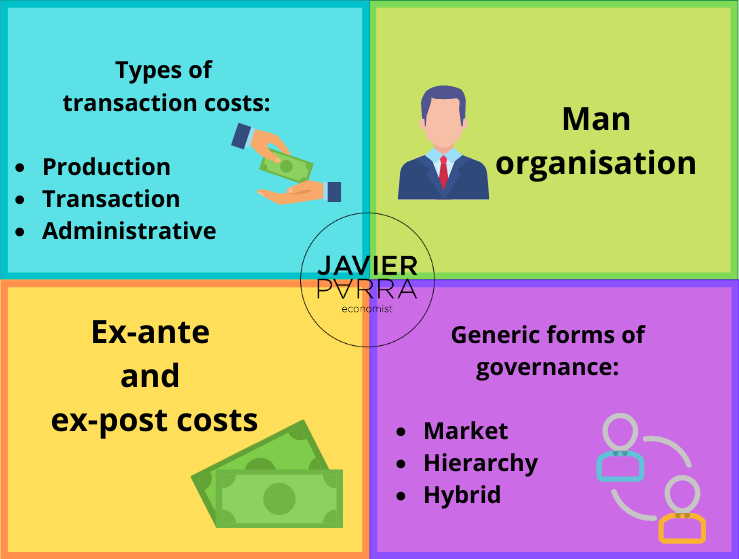

There are 3. types of transaction costs:

- Production

- Transaction

- Administration

The theory of transaction costs, as its name suggests, seeks to identify the sources of transaction costs, i.e. the characteristics and dimensions of a transaction, trying to find those transactions or processes that can make them problematic to find the most efficient way to economise on these costs. Efficiency is the criterion by which performance is measured, which is understood as a form of cost savings attributable to organised forms such as hierarchies, e.g. firms.

When we speak of transactions, in this case, we refer to the transfer of goods and services along the organisational boundary; this concept includes both the notion of exchange and the notion of contract since the contract implies a promise of future performance because it states that one party has made an investment whose return depends on the response of the other party involved. Transactions in which there is a contract are the central object of the study of transaction cost theory.

The nature of transactions has 3 attributes:

- Asset specificity.

- Frequency of transactions.

- Uncertainty of transactions.

How TCT works

Transaction cost theory explores the firm boundary and the transactions within it (those that are purchased, those that are outsourced and those that are jointly undertaken between two or more firms).

Williamson’s theory distinguishes between ex-ante costs (before the event), such as negotiating costs, information and contract execution activities, and ex-post costs (after the event), such as monitoring and reviewing contract performance. The “organisation man” (the individual involved in transactions and contracts) may experience limits in formulating and solving complex information processing problems.

Williamson, in this theory, refers to three generic forms of governance: market, hierarchical and a hybrid of both. In the market form, the parties are autonomous and have the incentive that derives from the flow of net revenues accruing due to cost reduction and efficient adaptation. On the other hand, hierarchy is characterised by cooperation, administrative controls, large bureaucratic costs offset by bilateral administrative gains and the absence of contract law and finally, there is the hybrid form of governance which is a combination of market and hierarchy in which incentives are sacrificed in favour of greater coordination.